As an online business owner, you must know how your users interact with your web app, landing page, website, or...

Questionnaire vs Survey: 4 Key Differences and Why They Matter

Surveys and questionnaires gather information from a specific group to meet a goal. In marketing, both are indispensable tools for gaining insights into customers’ behavior and opinions of a brand.

However, surveys are questionnaires, but not all questionnaires are surveys. And no, we shouldn’t use these terms interchangeably.

Learn the key differences between survey vs questionnaire and why this matters, especially when it comes to customer feedback.

What is a Questionnaire?

Think of a questionnaire as your straightforward tool for information gathering. It usually includes a series of written questions aimed at collecting responses from participants. Typically, participants answer open-ended questions and closed-ended questions, or a combination of both.

Questionnaires ask questions and collect data without any added complexity, allowing the questions themselves to guide the collection of insights. Each result will give you information about that specific respondent but won’t give you a bird’s eye view of whatever you’re asking the customer about.

What is a Survey?

On the other hand, surveys go a step further than questionnaires. They include both the set of questions and the analysis of data gathered.

A survey provides a comprehensive overview by taking you through the process of collecting data and then digging deeper into the reasons behind the answers. It involves the collection, analysis, and interpretation of information to understand a group of people or a particular topic better.

Surveys Vs. Questionnaires: What Are The Key Differences?

Both surveys and questionnaires play a huge role in various research methods. In marketing, you may use questionnaires and surveys simultaneously or separately, depending on your research goals.

To make it easier for you to determine which one to use, let’s dive deeper into their key differences:

1. Types of Data You Can Collect

Questionnaires are typically designed to collect quantitative data, which can be quantified and used for statistical analysis. This might include yes/no questions, multiple-choice questions, or rating scales.

While surveys can also collect quantitative data, they are handy for qualitative research. This includes open-ended questions that allow respondents to provide more detailed and nuanced answers, offering insights into their thoughts, feelings, and motivations.

A good example would be demographic questions for surveys that might collect both quantitative and qualitative responses.

2. Primary Purpose

The main goal of a questionnaire is to collect specific information directly related to the questions asked. It’s a tool for rapid data collection, focusing on gathering as many responses as possible from the target audience.

On the other hand, a survey goes beyond just collecting data; it aims to analyze data to uncover patterns, trends, and insights from the responses to help you meet specific goals. In other words, surveys are questionnaires but with added data analysis.

For instance, job applications collect data with no intention of statistical analysis. They just gather information necessary for HR purposes. Inversely, customer satisfaction surveys gather data with questions designed to measure certain metrics afterward and meet specific market research goals.

3. Data Analysis

Questionnaires don’t always require the data collector to perform any necessary analysis after the data has been gathered. The questionnaire itself is a means to an end, with the analysis process being separate and dependent on the goals of the data collector.

For example, when you give an employee a health screening questionnaire, you’re not aiming to analyze or evaluate the workplace’s overall health status. Instead, you’re just trying to see if that one respondent has any health conditions that you, as an employer, should know about.

On the flip side, surveys include the analysis as part of the process. They are often designed with the end analysis in mind, incorporating elements that enable the understanding and interpretation of the data within the survey process itself.

4. Data Collection Methods

Questionnaires can be distributed in various ways, including paper forms, online forms, or via email. The focus is on efficiently gathering data, so the method of distribution is chosen based on reaching the largest number of respondents in the specific target audience.

Surveys can also use these methods but might include additional approaches, such as interviews or focus groups, for collecting personal accounts. Surveys may employ a mixed-method approach to ensure both quantitative and qualitative data are gathered effectively.

When to Use a Survey vs Questionnaire

Surveys and questionnaires have unique strengths, depending on the circumstances and your current marketing goals. Here’s how to know when to conduct questionnaires vs surveys:

Use a Questionnaire When:

1. You Need Quick, Specific Answers

Questionnaires are the way to go if you’re looking for straightforward responses to specific questions without needing immediate analysis or interpretation. They are best for collecting factual data quickly and efficiently.

2. Budget and Time are Limited

Questionnaires are simpler to create and distribute, so they can be more cost-effective and quicker to deploy than surveys. They’re ideal when you need to gather data on a tight budget or schedule.

3. You’re Gathering Large Quantities of Data

If your goal is to collect a large volume of data from many people, the simplicity and directness of questionnaires make them a suitable choice. They can be easily scaled and distributed widely to gather information from a broad audience.

Use a Survey When:

1. You Seek Depth and Insight

Surveys are your best bet when you’re interested in not just what your respondents think but also why they think that way. If your objective is to explore opinions, beliefs, and attitudes in depth, the analytical component of surveys allows for a more nuanced understanding of quantitative and qualitative data.

2. You Have the Resources for Analysis

Surveys require more time and resources for proper execution, including the analysis of responses. Create surveys when you have the means to analyze the data thoroughly and are prepared to invest in interpreting the results for actionable insights.

3. Interaction and Engagement Matter

Surveys often allow for more interaction with respondents, providing opportunities to engage them in more meaningful ways. This is particularly important when the quality of the response is as critical as the response itself.

How to Conduct an Effective Survey or Questionnaire

Creating questionnaires and surveys requires different approaches. Here are essential steps and tips for each to ensure you collect valuable, actionable intelligence for any research project:

Conducting an Effective Questionnaire

- Define Your Objectives: Identify what you want to learn from your questionnaire. This will help you create questions that are direct and to the point.

- Keep It Simple: Use clear, concise language. Avoid jargon, technical terms, and long sentences. The easier your questionnaire is to understand, the more likely you are to receive accurate responses.

- Use a Logical Structure: Group related questions together, starting with general questions and moving towards more specific ones. This flow helps respondents provide more thoughtful answers.

- Offer Multiple-Choice Questions: These are easier and quicker for respondents to answer and simplify the data analysis process. However, ensure to include “other” options where necessary to not limit responses.

- Pilot Test Your Questionnaire: Before launching it widely, test your questionnaire with a small group similar to your target audience. This can help identify confusing questions or technical issues.

- Consider the Mode of Distribution: Decide whether an online platform, email, in-person, or another method is most effective for reaching your target audience. Choose the most accessible and convenient option for them.

- Analyze Data Systematically: Even though questionnaires are more straightforward, analyzing the data systematically will help you draw accurate conclusions.

Conducting an Effective Survey

- Establish Clear Goals: Know precisely what you want to achieve with your survey. Understanding your end goal will guide the type of questions you ask and the people you target.

- Craft Engaging Questions: Use a mix of closed and open-ended questions to gather quantitative data and qualitative insights. Ensure questions are unbiased and structured to encourage honest, thoughtful responses.

- Segment Your Audience: Tailor your survey to specific segments of your audience to ensure the questions are relevant to them. This will increase engagement and the quality of the data collected.

- Use an Appropriate Platform: Whether it’s online surveys, phone interviews, or mail-in surveys, choose a platform that suits your audience’s preferences and the nature of the information you’re seeking.

- Keep it Brief: Respect your respondents’ time. A survey that takes too long to complete may lead to respondent fatigue, resulting in incomplete responses or a high dropout rate.

- Test Your Survey: Before the official launch, conduct a pilot test with a small, representative segment of your target audience to catch any issues with question clarity or survey flow.

- Analyze and Interpret Data Carefully: Beyond numerical analysis, interpret open-ended responses to understand the nuances behind the data. This might require qualitative data analysis techniques.

- Follow-up: If your survey is longitudinal or if you promised to share results with participants, make sure to follow up. This not only builds trust but also encourages participation in future surveys.

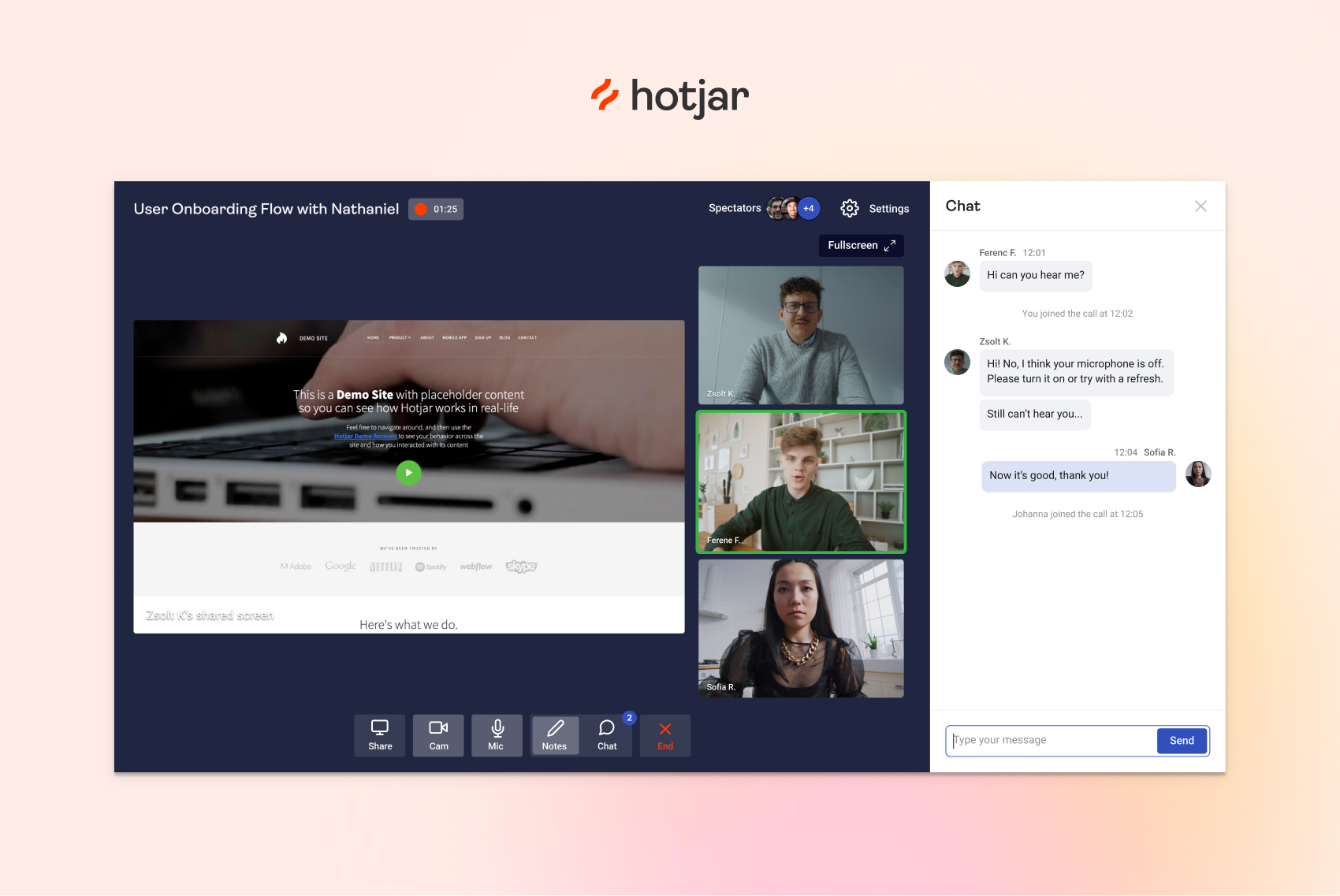

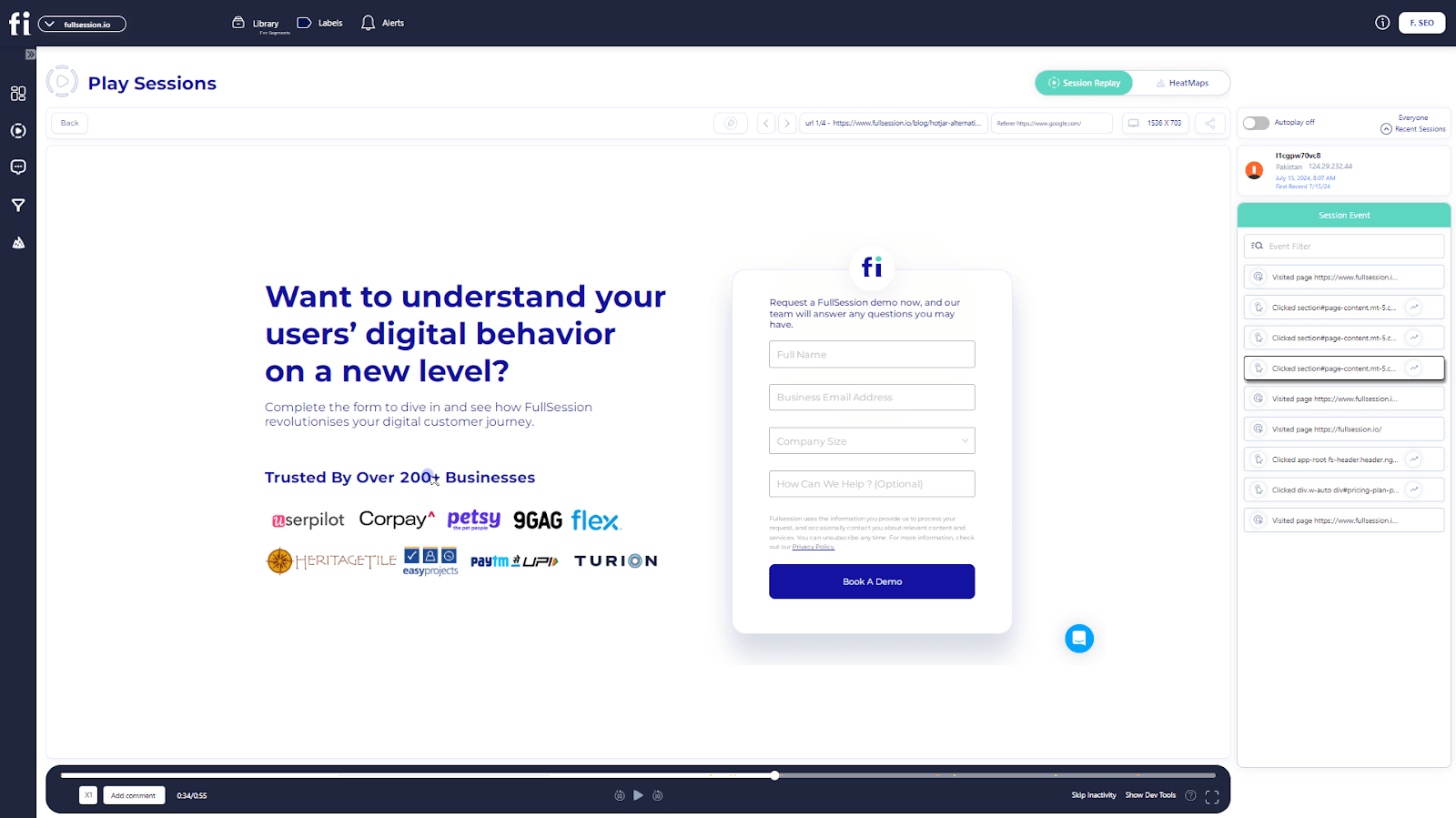

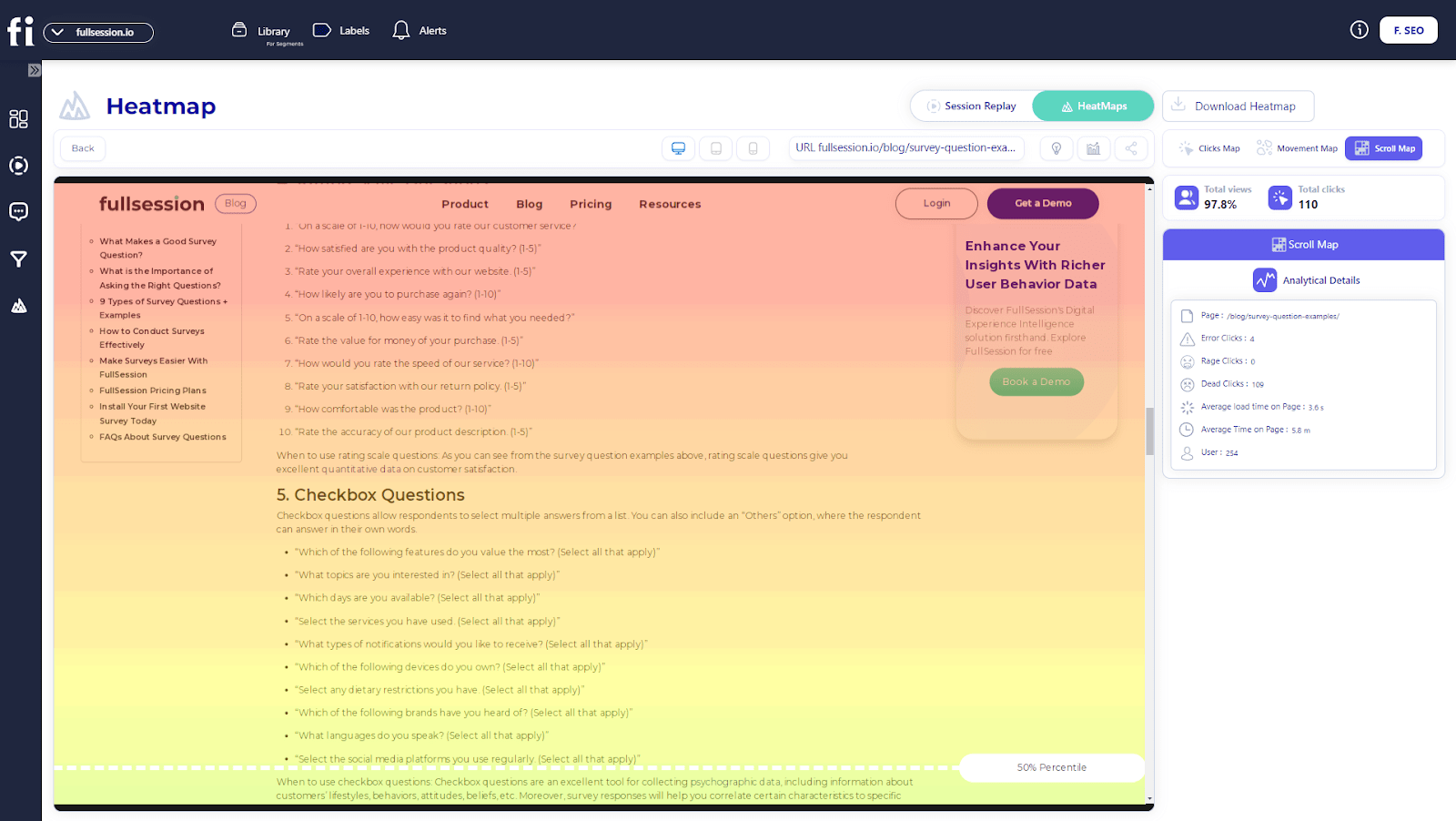

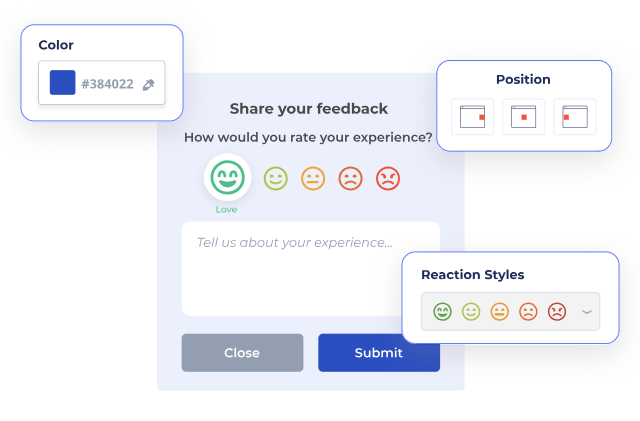

Conduct Surveys and Questionnaires With FullSession

Contrary to popular belief, gathering information from customers should be a constant process. Aside from conducting periodical surveys and questionnaires, let customers provide instant feedback on your website whenever they please.

FullSession lets you create customer feedback tools right on your website. FullSession will gather instant customer feedback from all your web visitors and automatically load relevant statistical information on your dashboard. Easy, intuitive, and powerful.

FullSession Pricing Plans

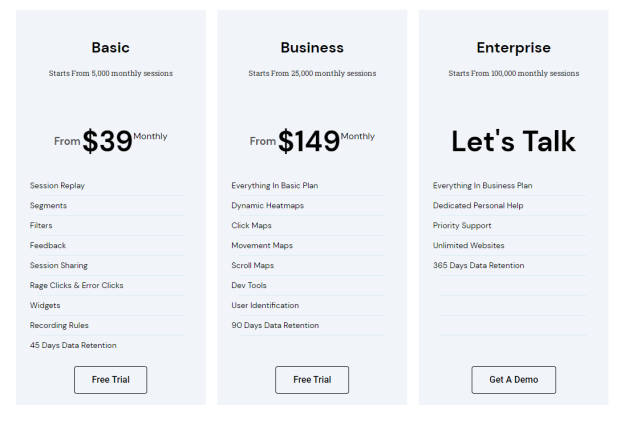

The FullSession platform offers a 14-day free trial. It provides two paid plans—Basic and Business. Here are more details on each plan.

- The Basic plan costs $39/month and allows you to monitor up to 5,000 monthly sessions.

- The Business plan costs $149/month and helps you to track and analyze up to 25,000 monthly sessions.

- The Enterprise plan starts from 100,000 monthly sessions and has custom pricing.

If you need more information, you can get a demo.

Install Your First Website Survey Right Now

It takes less than 5 minutes to set up your first website or app survey form, with FullSession, and it’s completely free!

FAQs About Surveys and Questionnaires

How long should my survey or questionnaire be?

The length of your survey or questionnaire should balance the need for comprehensive data with the attention span and availability of your respondents. As a rule of thumb, aim for a questionnaire that takes 5-10 minutes to complete and a survey that can be completed within 15-20 minutes.

How can I improve response rates?

To improve response rates, ensure your survey or questionnaire is concise, relevant, and easy to complete. Clearly communicate the purpose and how the data will be used to benefit respondents. Offering incentives, ensuring anonymity, and choosing a convenient distribution method can also significantly boost participation.

Should I use open-ended or close-ended questions?

It depends on your data collection goals. Use closed-ended questions when you need quantitative data that’s easy to analyze, such as demographic information or specific preferences. Open-ended questions are better suited for gathering qualitative insights, such as opinions, experiences, and suggestions. A mix of both can provide a comprehensive understanding of your respondents, balancing depth of insight with analytical simplicity.