Are you looking to optimize your website's performance but unsure if VWO is the right choice? You're in luck! We've compiled...

Churn Rate vs. Retention Rate (In-Depth Breakdown)

Churn rate and retention rate are two sides of the same coin. These rates are important for businesses to understand customer behavior.

The churn rate measures how many customers stop using a service over a specific period. On the other hand, the retention rate shows us the percentage of existing customers who stay.

Both metrics offer valuable insights into customer satisfaction and loyalty. In this blog, let's examine the debate on the churn rate vs. retention rate.

Explore what makes these rates important for companies to stay agile and competitive. And finally, discover how they can guide businesses in making informed decisions to keep their customers happy and engaged.

Churn Rate vs. Retention Rate

Understanding customer behavior is important in terms of a business relationship. That's where metrics like churn rate and customer retention rate come into play. They showcase performance in retaining customers.

What is Churn Rate?

Churn rate is the rate in which you lose customers or subscribers over a specific period. The calculation is the number of customers lost, divided by the total customers at the beginning of a period.

- Affect on Business Health: Churn rate measures the stability and loyalty in a customer base. A stable, low churn rate often correlates with longer term customers, whereas a high churn rate means customers are leaving very soon.

- Calculation Method: To get the churn rate, divide the lost customers by the starting customer count. Churn rate is typically measured as a percentage.

Importance of Churn Rate

The importance of churn rate can be seen in a few different measures about your business and customers.

- Indicator of Satisfaction: High churn rates raise a red flag about possible customer discontent. They prompt businesses to investigate and make necessary adjustments.

- Financial Health: The company's churn rate directly impacts how much revenue the company gets, especially for businesses with a subscription model. A high churn rate can significantly decrease predictable revenue streams.

- Growth Metric: Investors consider churn rate a pivotal indicator of potential growth. Low churn rates typically attract more investment opportunities.

Monitoring and Improving Churn Rate

Effective churn rate monitoring and improvement are important for customer retention.

- Customer Feedback: Collect feedback and satisfaction surveys to reveal the reasons behind customer departures. Companies use this insight to rectify issues and reduce churn rates.

- Engagement Strategies: Retention strategies aim to enhance customer loyalty. Businesses can implement targeted campaigns to keep the interest of existing customers.

- Quality Improvements: Offer product or service upgrades to meet growing customer needs. This approach can directly reduce the number of customers lost.

Challenges with Churn Rate

Businesses encounter multiple challenges in managing customer churn rates. Here are some of them.

- Market Dynamics: Adapting to changes in consumer preferences is essential to preventing a churned customer. Companies must stay ahead of trends to keep customers engaged.

- Competitive Market: To stand out in a crowded market helps in order to maintain customer interest. When a company offers unique benefits and features, it encourages customers to stay.

- Data Interpretation: The correct analysis of churn data enables businesses to identify controllable factors. Use data smartly to inform strategies to mitigate customer loss.

Reducing Churn

To reduce churn, it is important to keep customer acquisition costs low and maintain a healthy bottom line.

- Voluntary vs. Involuntary Churn: Voluntary churn means customers choose to leave. On the other hand, involuntary churn refers to losing customers for reasons outside customer control. It's important to distinguish the specific churn as each type requires different strategies to address.

- Reduce Customer Churn: Running engagement campaigns and testing your customer base can help you reduce churn.

Average Churn Rate

The average churn rate measures the proportion of customers a business loses within a given timeframe compared to the beginning total. This average provides insight into your customer retention rate trends over time. In turn, this allows for strategic adjustments to business practices.

Industries vary widely in what constitutes an acceptable average customer churn rate; however, companies benefit from continually minimizing this figure to enhance customer loyalty and stabilize revenue.

Annual Churn Rate

The annual churn rate calculates the percentage of customers lost over the course of a year. This metric is crucial for assessing long-term customer retention and satisfaction.

Hence, this impacts financial planning and business strategy. A lower annual customer churn rate indicates a stable customer base and contributes to healthier and more sustainable growth.

Customer Acquisition Cost and Churn Rate

Customer Acquisition Cost (CAC) refers to the total cost of acquiring a new customer, including marketing and sales expenses. The relationship between CAC and churn rate is significant.

A high churn rate can make CAC unsustainable. This is because the rapid loss of newly acquired customers fails to compensate for the investment made to attract them.

Businesses that strive for profitability must balance these figures. Companies must lower churn rates and optimize acquisition costs to ensure long-term customer value exceeds the initial expenditure.

What is Retention Rate?

Retention rate is a main metric for evaluating business performance and customer loyalty. It denotes the proportion of customers a company retains over a certain period.

The rate is calculated through a specific formula based on the number of customers a company retains. This is relative to its number at the start of the period.

- The aspect of Customer Loyalty: Customer retention rate serves as a parameter of customer loyalty. A high rate implies a high percentage of satisfied customers who continue to use a product or service.

- Computation Method: The formula for customer retention rate includes subtracting the new customers from the end count, dividing by the initial count, and multiplying by 100. This calculation provides the percentage of customers who stay with the business.

Importance of Retention Rate

A good customer retention rate is an essential factor that businesses closely monitor.

- Customer Lifetime Value: A higher customer retention rate increases the customer lifetime value. This increase benefits the revenue stream and profitability of the company.

- Business Stability: A consistent customer retention rate represents business stability and increases repeat business. It illustrates a clear indicator of customer satisfaction with the product or the service.

- Marketing Strategy: Strong customer retention rates suggest the effectiveness of the marketing strategy. It reveals the success of a company in order to keep customers engaged and satisfied.

Ways to Improve Retention Rate

Strategies to improve the average customer retention rate often focus on customer satisfaction and engagement.

- Customer Service: Superior customer service often leads to higher customer retention rates and increases repeat business. Focusing on new customers and existing customers in support is beneficial.

- Regular Updates: Businesses earn customer loyalty through continuous improvement of products or services. Updates that appeal to user requests results in retaining customers.

- Personalization: Personalized experiences cater to individual customer preferences. These tailored experiences foster a sense of relationship and improve retention.

Challenges with Retention Rate

Improving customer retention rates requires a company to overcome several challenges.

- Customer Expectations: To meet the needs of customers is an ongoing challenge. Customer expectations can affect customer churn rate, but also your customer retention rate.

- Market Competition: Businesses operate within a competitive market. To offer a unique value proposition to maintain a high customer retention rate.

- Measurement Accuracy: It is important to guarantee accurate measurements of the customer retention rate. Companies need to analyze and interpret data carefully to drive strategic planning effectively.

Understand and enhance the customer retention rate to strengthen the customer base. It helps the business thrive in a competitive market while the company secure committed, long-term customers.

Calculating Churn Rate vs Retention Rate

To keep a business healthy, we must understand how to calculate the churn and customer retention rates, which are important. These rates help determine how well a business keeps its customers over time. Here's how to do these calculations:

Churn Rate Formula

- To calculate the churn rate, pick a time period (like a month).

- Count how many customers left during that time.

- Divide the number of customers who left by the total number of customers at the start of the period.

- Multiply by 100 to get the percentage.

Retention Rate Formula

- To calculate the retention rate, choose the same time period.

- Subtract the number of new customers acquired during this period from the total number of customers at the end of the period.

- Divide this number by the total number of customers at the start.

- Multiply by 100 to get the retention rate percentage.

Average Rates

- Average Churn Rates: This is an industry-specific benchmark. It varies, but knowing it helps businesses understand if they're above or below the norm.

- Average Retention Rate: Similarly, this average helps businesses gauge customer loyalty against standard benchmarks.

High retention rates are good, as they reflect the customers retained. This, in turn, increases repeat business or repeat customers.

A low churn rate is also positive, which indicates few customers leave. Companies strive to increase retention and decrease churn to grow and remain profitable.

Metrics of Customer Retention and Customer Churn

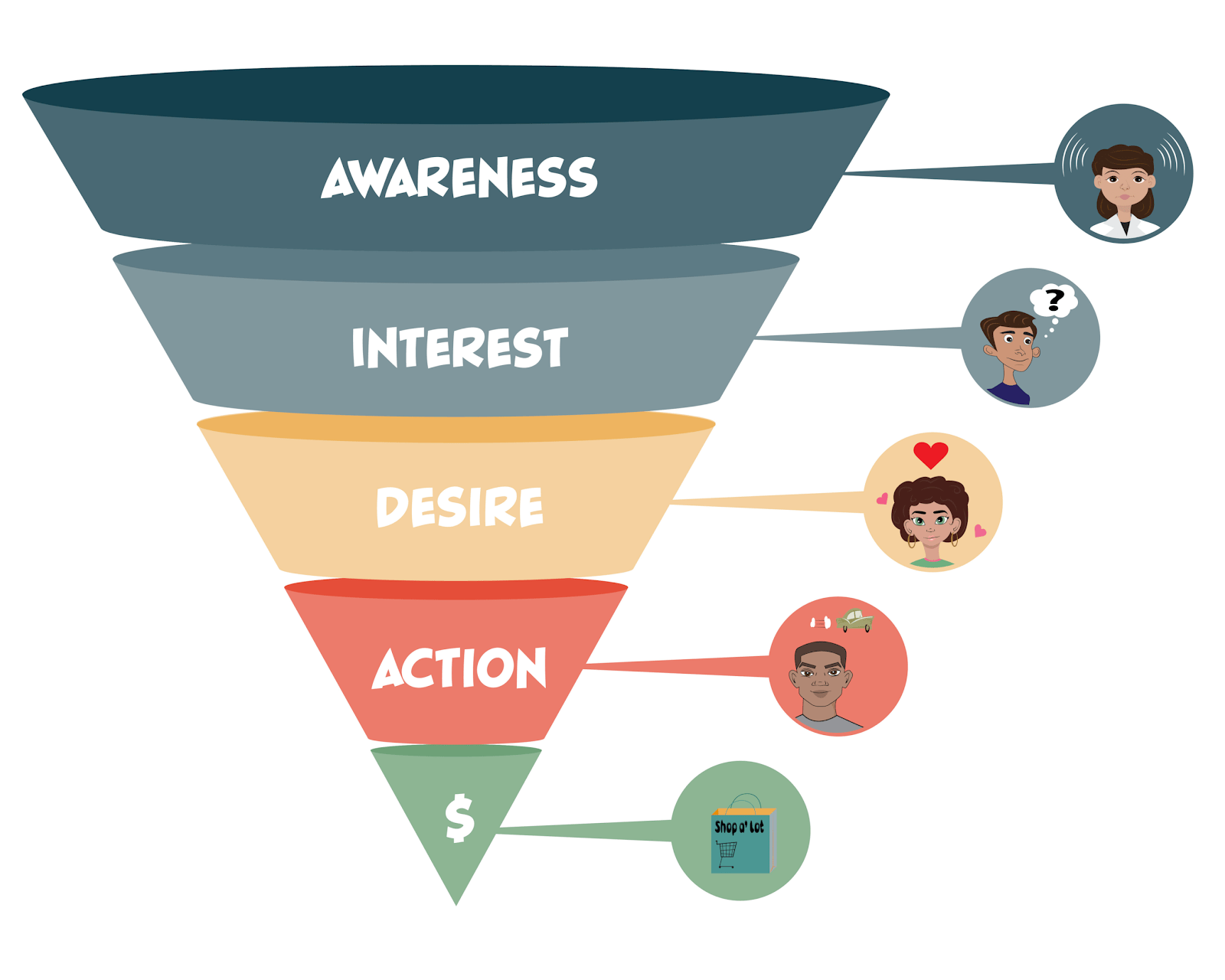

Understanding the dynamics between churn and retention rates helps businesses maintain a robust customer base.

- Contrasting Metrics: Churn rate refers to the portion of customers who stop using a business's services. In contrast, retention rate measures the repeat purchase rate or the percentage of customers a business successfully retains over a given period.

- Inverse Relationship: Typically, these metrics hold an inverse relationship; as the churn rate rises, the retention rate tends to fall, and vice versa.

Customer Satisfaction and Loyalty

Customer satisfaction directly influences customer retention rate and customer churn rate.

- Loyal Customers: Higher customer satisfaction often results in a base of loyal customers who are more likely to make repeat purchases.

- Poor Customer Service: Conversely, poor customer service is frequently a primary driver of customer churn, which underscores the importance of excellent customer service to retain customers.

Financial Implications

Monthly recurring revenue is generated, and the customer lifetime value hinges significantly on customer retention metrics.

- Revenue Churn Rate: The revenue churn rate quantifies how much average revenue is lost due to losing customers. This can parallel the number of existing customers but considers the varying revenue each customer represents.

- Customer Lifetime Value: This value increases as the retention rate improves, which shows why a high retention rate is as significant as acquiring new customers, if not more so.

Customer Base and Revenue

The sizes of the existing customer base and the generated revenue allow businesses to measure customer retention effectively.

- Number of Customers: Track the number of customers who remain versus the number who are acquired or lost. This provides a straightforward representation of churn and retention trends.

- Revenue Churn vs, Growth: A comparison between revenue churn and revenue gains from new customers or repeat business can help accurately predict a company's future performance.

Engagement and Feedback

In order to retain customers, proactive engagement and a thorough analysis of customer feedback is needed.

- Customer Feedback: Customer feedback is a valuable source that informs businesses on how to improve retention and minimize churn.

- Customer Success Team: This team plays a strategic role in order to reduce churn by helping customers achieve success through the use of a product or service. Hence, this improves the overall customer experience.

Retention Over Time

Churn rates and retention rates gain significance when observed over regular periods, such as monthly churn and an annual retention rate.

- Monthly Churn: A company might closely monitor its monthly churn to assess how frequent service or pricing adjustments affect customer behavior.

- Annual Retention Rate: Examine the annual retention rate to get insight into the longer-term satisfaction and fidelity of the customer base.

Increase Your Retention Rate With FullSession

Don’t hesitate to start gaining actionable insights into user behavior by looking at how FullSession works. You can test our solution by signing up for a free trial or scheduling a demo.

FAQs About Your Churn Rate vs Retention Rate

What's the difference between churn rate and retention rate?

The churn rate calculates the percentage of customers who leave a service, while the retention rate measures the percentage of customers a company retains.

Why is it important to monitor both churn rate and retention rate?

Monitoring both rates provides a complete view of customer behavior and company performance. This may indicate areas of success and those that need improvement.

How can companies improve their retention rate?

Companies can enhance their retention rate through improvement in their customer service, implement customer feedback, personalize customer interactions, and create a proactive customer success team.

What impact do churn rate and retention rate have on revenue?

A high churn rate can lead to revenue loss and increased acquisition costs, while a high retention rate results in stable revenue flows and higher customer value.

Can a high churn rate ever be beneficial?

Sometimes, a high churn rate can help identify unprofitable customers, which enables better targeting. However, it generally indicates areas for improvement.

How often should companies monitor their churn and retention rates?

Companies should frequently monitor these rates, with the exact frequency that depends on the business model and industry. Consistent monitoring allows timely corrective actions.